Kingdom of Denmark has implemented the European Green Bond Standard

Denmark’s Green Bond Programme has been updated as of September 2025. The programme now complies with the European Green Bond Standard (EuGB Standard) and is fully aligned with the EU Taxonomy ensuring a high level of transparency, credibility, and environmental integrity.

By adopting the EuGB Standard, the programme strengthens the Kingdom of Denmark’s role in developing green capital markets, both domestically and globally, and reinforces Denmark’s commitment to financing the green transition.

Kingdom of Denmark

European Green Bond Investor Day

See presentation here

Committed to support the transition to a sustainable economy

The Kingdom of Denmark issued its first green bond in 2022 under the Green Bond Framework and conducted green bond issuances under this framework from 2022 to 2024.

Starting in 2025, green bond issuances will adhere to the EuGB Standard. This transition reflects Denmark’s commitment to transparency and sustainable finance, introducing a European Green Bond Factsheet aligned with the highest standards for green investments.

An amount equivalent to the proceeds from the issuance of European Green Bonds (EuGBs) will be allocated to green expenditures and investments undertaken by the central government.

Below is a summary of the documentation underlying the Danish government's green bond issuances:

Green Bond

|

European Green Bond Factsheet |

|

Use of Proceeds

|

Use of Proceeds

|

|

Documentation |

Documentation

|

|

Reporting |

Reporting

|

European Green Bond Factsheet (2025-)

Green bonds issued from 2025 will be issued as EuGBs under a European Green Bond Factsheet, launched in September 2025. The Factsheet reflects the ambition to uphold the highest standard for green bonds and contribute to enhancing transparency in the green bond market. The European Green Bond Factsheet has been reviewed by the approved external reviewer Sustainable Fitch, which has assessed:

1. Alignment with the EuGB Standard (link), which means that each expenditure substantially contributes to at least one of the six environmental objectives without doing significant harm to any of the other five environmental objectives, as laid out in the EU Taxonomy. Further, the eligible green expenditures comply with minimum safeguards.

2. Alignment with the ICMA Green Bond Principles (link) by following the four core components laid out here.

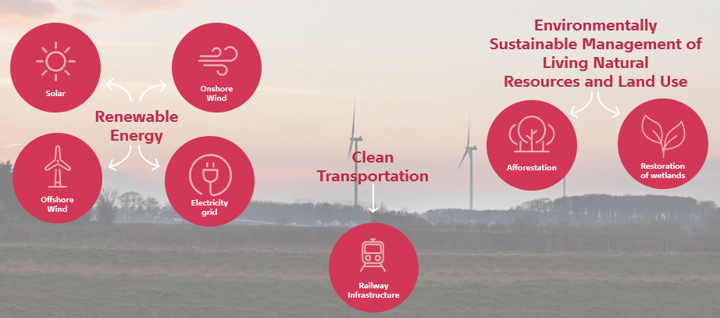

The EuGBs will support various green projects, such as renewable energy initiatives, clean transportation, and the sustainable management of natural resources. The eligible green expenditures included in the Kingdom of Denmark's European Green Bond Factsheet support:

1. Renewable energy

Production of renewable energy, including wind and solar energy

2. Clean Transportation

Green transition of the transport sector

3. Enviromentally Sustainable Management of Natural Resources and Land use

Afforestation and restoration of wetlands

The Kingdom of Denmark’s European Green Bond Factsheet is programmatic rather than transactionspecific and will be used for EuGB issuances from 2025 onwards.

The projected amount of eligible green expenditures can be found in the document Annex IV Projected Eligible Green Expenditures. The amount of eligible green expenditures for a given year is updated annually.

In line with the Kingdom of Denmark’s European Green Bond Factsheet, the Ministry of Finance will publish allocation and impacts reports.

For a summary of the European Green Bond Factsheet, please read: European Green Bond Factsheet Booklet

Green Bond Framework (2021-2024)

The green bonds issued between 2022-2024 are governed by the Kingdom of Denmark's Green Bond Framework, which describes the principles of these green bonds, including the criteria for the selection of expenditures that were eligible to be refinanced by the proceeds from these green bonds.

Eligible green expenditures in the Kingdom of Denmark's Green Bond Framework were evaluated and selected based on the definitions and criteria in the EU Taxonomy.

The eligible green expenditures included in the Kingdom of Denmark's Green Bond Framework support:

1. Renewable energy

Production of renewable energy, including wind and solar energy

2. Clean Transportation

Green transition of the transport sector

In line with best market practice, an assessment of the Kingdom of Denmark's Green Bond Framework has been obtained from an independent reviewer. The independent assessment (Second Party Opinion) was conducted by Cicero (later S&P), which rated the Kingdom of Denmark's Green Bond Framework 'Dark Green' – the highest possible environmental grade. The Kingdom of Denmark's Green Bond Framework is further aligned with the Green Bond Principles (2021) from the International Capital Market Association (ICMA) and has sought to align with the proposed regulation on a EuGB Standard from July 6th 2021.

In accordance with the Kingdom of Denmark’s Green Bond Framework, the Ministry of Finance publishes allocation and impact reports.

Proceeds from the issuance of green bonds under the Kingdom of Denmark's Green Bond Framework amount to 32 billion and have been allocated to government expenditures in 2021-2023, see allocation reports.

For a summary of the Framework please read: Green Bond Framework Booklet

Green Bonds are issued as twin bonds

All green government bonds issued by the Kingdom of Denmark (under both the Green Bond Framework and the European Green Bond Factsheet) are issued as twin bonds. This implies that the green bonds will be issued with the same financial characteristics as one of the central government's existing conventional on-the-run bonds, i.e. the same maturity, interest payment dates, and coupon rate.

The twin bond concept supports the liquidity in the green bonds, as investors, at any time, will have the opportunity to switch the 10-year green bond to the corresponding and more liquid conventional 10-year twin bond, one-to-one. However, investors will not be able to switch the conventional twin bond to the corresponding green bond.

See below a list of issued green bonds and twin bonds:

Green bonds

| Status | Security name | Redemption date | ISIN | Governance | Twin bond | Terms of Borrowing |

| On-the-run | DGB 2.25 per cent 2035 EuGB | 15 November 2035 | DK0009925182 | European Green Bond Factsheet | DK0009924961 | link |

| Off-the-run | DGB 2.25 per cent 2033 G | 15 November 2033 | DK0009924615 | Green Bond Framework | DK0009924532 | link |

| Off-the-run | DGB 0.00 per cent 2031 G |

15 November 2031 |

DK0009924375 | Green Bond Framework | DK0009924102 | link |